GST and the impact on Healthcare

The Goods and Services Tax or GST is coming – tabled in Budget 2014, it is scheduled for implementation in April 2015. The rate is set at 6% and it will replace the current Sales and Service Tax. Stakeholders will surely be interested in how the GST will affect the healthcare sector.

The Health Minister initially denied GST will affect healthcare

(Star: GST will not impact healthcare costs, Malay Mail: Health services will be GST-exempt)

This was quickly refuted by others (MI: Health Minister ignorant or lying about impact of GST on healthcare costs, says DAP) and questioned by FMT in Will GST prick our health?.

Later on the honorable Minister back tracked somewhat and admits GST for healthcare, pledges minimal effects

The confusion lies in the point that was brought up in the budget 2014 that “Healthcare by private services” is exempted under the GST but does not include medicine.

While there is “no GST on healthcare services” just considering that GST applies to drugs alone one will expect inflated drug costs in 2015.

from MM: Healthcare costs to spike post-GST

“The Health Minister, and many other Barisan Nasional (BN) leaders is obviously either ignorant about what is meant by GST-exempt, or chose not to be truthful about it,” Pua said in a statement here.

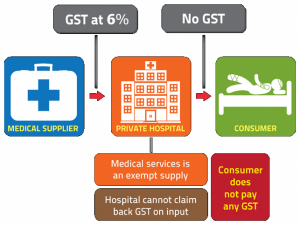

Citing the explanation on the government’s GST website, the lawmaker pointed out that in essence, a GST-exempt product or service merely means that no GST will be imposed by the provider to the consumer.

However, he said, the provider of these healthcare products andn services such as hospitals would still be charged the GST on all products and services it purchases from its suppliers.

“For example, a hospital currently purchase a drug from the medical supplier for RM50, and sold it to patients at RM55 for a 10 per cent profit margin.

“After the implementation of the GST, the hospital will have to pay the medical supplier RM50 plus 6 per cent GST, amounting to RM3. The cost to the hospital would hence increase to RM53.

“If the hospital were to maintain the price of the drug to the consumer, then the hospital will only be making a profit of RM2 or a 3.8 per cent profit margin,” Pua explained.

He said Subramaniam must be “daydreaming” to believe that Malaysian hospitals would be magnanimous as to absorb all the GST-induced increase in cost and continue to provide its products and services to the public at existing prices, ultimately suffering a severe squeeze in profitability.

As such, Pua said the big question is not about whether the prices of healthcare products and services will increase, it was a question of how much it will increase.

GST will be a burden for GPs and doctors in general. Hospitals will be affected too and undoubtedly costs will be passed on to consumers one way or the other.

For doctors, especially GPs, interested to know and discuss about GST, there is a detailed discussion going on in the Dobbs Forum for Malaysian doctors: GST is coming. There are questions like is it true that there is a threshold of “RM500k for business turnover to get GST exemption”? What are the implications of registering as a GST registered service? For doctors who are not yet members of Dobbs, do note that Dobbs is free for all Malaysian doctors – just submit this form to register.

See also the MMA FB Page: GST – and the devastating effects on GPs